Let’s discuss Sin Stocks

Paige Hennessy

Published 29 November 2022

ANALYSIS: As ethical investing grows in awareness we consider the historical outperformance of ethically murky stocks.

The term ESG (Environmental, Social and Governance) was officially coined in a 2005 UN report titled “Who Cares Wins”. The report made the case that integrating ESG considerations into financial markets would lead to more sustainable outcomes for both markets and societies. Despite ESG as a phrase being relatively young in a long history of financial markets, ESG considerations in investing has existed for centuries before it had a name. Ethically based investment practices can be traced back to the 1700’s when Quakers in the United States would exclude slave labour from their investment practices.

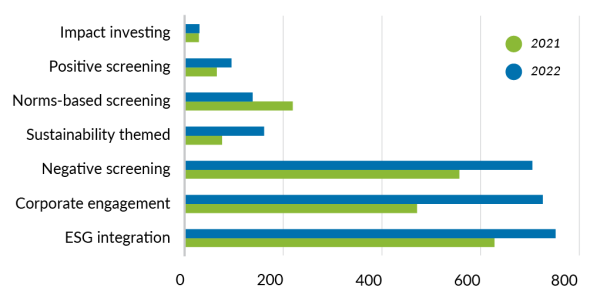

There are a number of approaches to implementing an ESG strategy within a portfolio. According to data published in September by the Responsible Investment Association Australasia (RIAA) ESG integration, corporate engagement and negative screening (exclusions) are the three most popular approaches to responsible investing and continue to grow in popularity at the fastest rate.

Responsible Investing - Type of Approach (ASm)

Source: Responsible Investment Association Australasia 2022 Australia Benchmark Report

Exclusion is one of the oldest strategies in responsible investing implementation. It is a popular tool utilised for blanket exclusion of ‘sin stocks’. Sin stocks are typically defined as companies involved in activities such as alcohol, tobacco, gambling or weapons, this is despite the fact that these industries are generally legal activities where significant minorities, or in the case of alcohol, a majority of society participate. Despite their legality, many of these investments are automatically barred from portfolios on ethical grounds. Indeed, the RIAA’s survey reveals that 70% of respondents use negative screening as a tool to filter out the tobacco industry, the highest excluded industry in their ESG survey.

There is a lot to be said for positioning a portfolio defensively if we believe a recession is likely. Sin stocks have long been considered to be recessionary proof, reason being – people drink, smoke and gamble in both good times and bad: in other words, consumption is inelastic. Various studies have shown that sin stocks deliver better returns than stocks in general, a 2019 UBS article “Sin Stock Exclusions: What is the Impact?” found that over a 43 year period, a market weighted portfolio of sin stocks outperformed the MSCI All World Index by 4.9% annually. Since 2008, Philip Morris, the largest tobacco company by market cap, has outperformed that same index by 0.8% annually.

Fundamentally, there are a number of explanations for why sin stocks have outperformed. First, the exclusion of certain sin stocks by large investors, typically institutional, will result in the prices of those stocks being depressed relative to their fundamental valuation. This allows investors willing and able to invest in sin stocks to arbitrage this pricing impact. In essence, the very act of exclusion gives rise to an elevated return profile. This premium can be interpreted as compensation for accepting the higher risk of litigation or reputational impacts involved in holding sin stocks in the expectation of higher returns. Hand-in-hand is the fact that exclusion deprives these companies of cheap capital or funding which in turn increases the cost of capital. This in itself implies there is a premium if you believe that the long run return of a stock should be equal to its cost of capital.

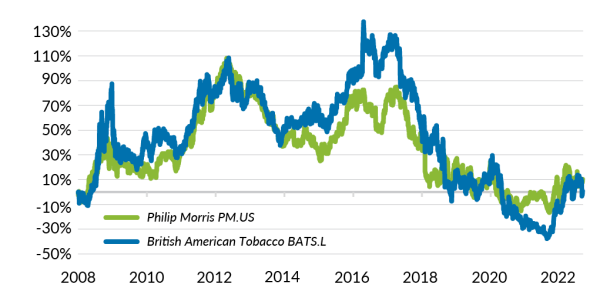

Consistent with this view over the longer-term, one could also interpret this perpetually higher cost of capital as an acknowledgement that investors may ultimately receive a discount, instead of a premium, as many of these businesses may eventually turn out to be in terminal decline, resulting in poor long-term returns compelling short-to-medium term profits: timing is everything! Interestingly enough, tobacco heavyweights such as Philip Morris and British American Tobacco have underperformed the MSCI All World Index by -24% and -46% respectively over the past three years. Three years is a relatively short period and Covid-19 has had a significant impact on markets but perhaps this could be a sign for tobacco companies that this risk is closer than ever, whether from Government policies or regulations, the rise of vaping or even changing societal preferences.

Tobacco Relative Outperformance against MSCI World Index

Source: Refinitiv

If you don’t want to own sin stocks perhaps you can get similar investment return characteristics elsewhere. In 2015 investment theorists Fama and French updated their famed three-factor model which looked to explain investment returns to include an additional two factors. The original model looked at ‘market risk’, ‘size’ and ‘value’ factors to explain why some stocks outperformed. The two new factors considered ‘profitability’, identifying companies that had high operating profitability, and ‘investment’, companies that have had low asset growth. When this updated five-factor model was back tested on sin stocks in the US it explained the historical outperformance of these companies whereas the previous three-factor model had failed to do so. Theoretically, this means that investors in favour of exclusion could proxy sin stock returns by weighting portfolio exposures toward those Fama-French characteristics including companies with high operating profitability and low asset growth. Admittedly proxies are never perfect and you need a large investment universe for this to work effectively.

The RIAA chart above highlights that there is no ‘one’ approach to considering ESG or responsible investing principles in portfolio construction. What approach is selected is dependent on the portfolio strategy, investor, manager and each stock applicable for inclusion in that portfolio. As an individual investor, it is important to be able to incorporate your ethical beliefs into your investments as you see fit. In order to do so it is necessary that we pay attention to how excluded investments have performed, and the reason of their performance, in order to be able to build portfolios that adhere to ethical principles without comprising our risk-return expectations. What we can do is utilise fundamental valuation theory and models such as Fama-French to help us determine the best fit.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. It does not contain financial advice. This article was supplied free to NBR and first published 25 November 2022.