Geopolitical Risks to your Portfolio in 2024 and Beyond

Tobias Newton

Many of you checking your Kiwisaver and investment balances over the holidays would have been pleasantly surprised by the performance of your portfolios in the final months of the year. In the course of two months we saw a spectacular rally in most asset classes with benchmarks in global equities (+14.5%) global bonds (+8.5%) and global (listed) real estate (+21.4%) in USD terms1. It was an exceptional end to the year.

We shouldn’t become complacent or get caught in the recent upward momentum of the market. This sharp rise in asset prices has left valuations vulnerable to correction in all but a true ‘Goldilocks’ scenario for the global economy. For context the ‘Goldilocks’ scenario sees falling inflation and interest rates, modest GDP growth and stable employment. This scenario seems a difficult prospect given the volatile geopolitical backdrop we’re facing this year.

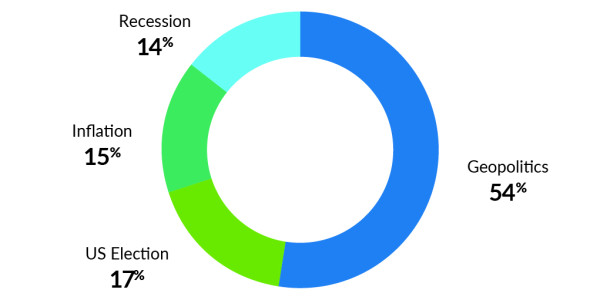

When attendees at the Goldman Sachs Global Strategy Conference held in London earlier this month were asked; ‘What is the biggest risk for the global economy and markets in 2024?’ those participating in the survey overwhelmingly favoured geopolitics, with the US election coming in second.

Fig. What is the biggest market risk for the global economy for 2024?

1 *Indices referred to are represented in USD terms and include the MSCI ACWI Net Total Return Index, Bloomberg Global Aggregate Index and the S&P Global REIT Index respectively.

What are the key geopolitical risks and conflict arenas?

● Increased Taiwan/China tensions in the Straits of Taiwan and South China Sea (critical parts of the global supply chain);

● Broadening of the conflict in the Middle East (a region which accounts for close to a third of global oil production); and

● Significant changes in US foreign policy direction as the country goes to the polls in November; (Implications for Russia/Ukraine, US/China relations).

Taiwan/China tensions – What do we know?

The Taiwanese presidential election was held on 13th January 2024 and the outcome saw the pro-sovereignty candidate Lai Ching-te elected as president. Despite losing a legislative majority, the Democratic Progressive Party (DPP) has won its third consecutive term in government. The party has expressed the view that Taiwan is essentially a sovereign nation (independent of China), favouring the development of greater defence capabilities and deepening relations with other democratic countries, namely the US and its allies. This contrasts with the position of Beijing, who have maintained the ‘One China’ policy, asserting sovereignty over Taiwan. The election outcome suggests further escalation may be on the cards here if China reacts with military intimidation or by applying economic sanctions.

One scenario could see China extending Naval and Air Force manoeuvres in the Taiwan Strait and broader region, to the extent that they disrupt the flow of trade through key shipping channels and deter investment in Taiwan. We should not underestimate the importance of Taiwan in the global economy. In fact Taiwan produces 60% of the world’s semiconductors, and 90% of the most advanced ones. These chips power everything from mobile phones to electric cars and are critical to the development of AI.

No doubt then, a move by China as above would prompt a strategic response from Taiwan, and potentially the US given existing tensions. Escalating conflict would be negative for global trade and economic growth with a potential chip shortage having wide ranging implications for equities, with some of the world's most valuable companies like Apple (AAPL) and Nvidia (NVDA) among the largest customers for Taiwanese manufactured Semiconductors.

Israel/Palestine and Middle East oil risks – What do we know?

Tensions have been rising in the Middle East as Israel continues its military campaign in Gaza, with Israel vowing to ‘destroy Hamas’. The offensive has sparked aggression from Yemen-based Houthis rebels who have been targeting container ships in the red sea. This is already disrupting normal trade flows into Europe with many shipping companies diverting their fleet around the Cape of Good Hope at the southern tip of Africa, increasing the total shipping distance from Shanghai by 25% compared with using the Suez Canal (Source: Flexport).

So far, ocean shipping rates between Asia and Europe have more than doubled with the lengthier trip shrinking global shipping capacity. Market estimates suggest the increase in shipping costs could eventually add 0.5% to inflation, boosting the costs of clothing, footwear, furnishings and grocery items which were a key source of global disinflation in 2023.

US election & policy direction – What do we know?

More than half the world’s population, spread across 70 or more countries, will go to the polls to elect governments in 2024. The 2024 US election is the main event and has the potential to spread uncertainty across global markets with the outcome potentially bringing meaningful changes to foreign policy. A Trump/Biden rematch is currently the most likely scenario, with opinion polls narrowly favouring Trump in a head to head (though within the polling margin of error).

As the election outcome becomes clearer and policies better understood we could see moves by chief US rival China, or perhaps Russia, as they seek to strengthen their own spheres of influence (most obviously in Taiwan for the former and Ukraine/Europe for the latter). Increased division and polarisation in the US electorate heightens risk that the norms around peaceful transition of power are challenged, with the Capitol Riots of January 2021 a prime example. This division could embolden the actions of foreign players.

One potential change to foreign policy under a Trump administration is a desire to rapidly resolve the conflict in Ukraine, with Trump previously suggesting peace talks would be an ‘easy negotiation’ between Zelensky and Vladimir Putin. Ukraine relies heavily on US and European backing for its war effort so any wavering in support for Ukraine could encourage Russian aggression.

Historically Trump has taken a particularly hard line on China, at one stage proposing a 45% tariff on all Chinese imports. Trump’s election could see the US put greater pressure on its allies to enforce intellectual property protections, increase controls on investment by Chinese firms or apply tariffs to Chinese imports. This kind of policy mix could even spark a trade war later in 2025. Imposing broad based tariffs could have a significant effect on US inflation and domestic consumption near term as supply chains scramble to respond.

A more substantial US/UK led military response to the attacks may precipitate greater instability in the region, were other states, notably Iran to react. A direct confrontation with Iran (rather than its proxies like Houthis and Hezbollah) risks broad regional destabilisation. Conflict would have wide-ranging implications for the global economy, disrupting energy markets which have been fairly settled in recent months and reigniting global inflation risks.

Implications for your portfolio

In response to these conflicts and risks, we’ve seen a reversal in the multi-decade trend toward globalisation. In the current environment, there is an instinct toward companies and states ‘near-shoring’ and ‘friend-shoring’, where manufacturing operations and commodity supply chains are shifted toward key strategic allies and for geographic proximity. Over time, this theme will create winners and losers in the global economy, indeed Citi Research noted that US imports from Mexico surpassed imports from China in 2023 after being only around 60% of China's share in 2016. Corporates will need to be agile.

The current geopolitical backdrop poses a risk for the valuation of your investments. Increasing risk aversion among investors tends to benefit lower risk assets, particularly shorter-term US government bonds, whilst global equities have tended to respond poorly as risk premiums rise. Along with US government bonds, ‘safe-haven’ assets like Gold (or gold mining equities) and certain currencies like the Swiss Franc or Japanese Yen have traditionally offered protection during geopolitical episodes.

In terms of shifting within and between asset classes, you commonly see the following trades when trying to de-risk and add resiliency to portfolios.

1) In fixed interest/credit, increase sovereign/government bonds versus securities with credit risk as geopolitical uncertainty sees credit spreads widen. Between countries, developed markets tend to outperform emerging markets with a flight to quality.

2) Within equities investors tend to rotate into the defensive sectors of the market, these include ports/infrastructure, healthcare stocks and consumer staples like supermarkets. The same flight to quality sees investors shift from emerging to developed markets.

3) Gold (or gold mining equities) offers stability as a store of value and tends to appreciate in a risk-off environment.

4) Core real estate and infrastructure in ‘safer’ geographies can outperform as these real assets are supported by stable income streams, typically less exposed to supply chain disruption and energy crises. These assets also benefit from lower interest rates.

5) Currency is discussed above, but the USD (global reserve currency), Swiss Franc and Japanese Yen tend to appreciate in times of trouble.

6) The jury is still out on bitcoin as a store of value. Speculative capital flows around events seem to dominate. For example, recent price action has been broadly attributed to the recent ETF approval by the US Securities Exchange Commission (SEC).

The trick here is not to de-risk too much. Even relatively small allocations can provide a valuable hedging benefit. We want to embed resilience without missing the ‘snap back’ rotation into risk assets as prices can rise quickly once uncertainty is resolved.

Tobias Newton is an Equity Analyst at Octagon Asset Management.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

This is supplied content and not commissioned or paid for by NBR.