This article is not about the profitability of banks in New Zealand – well performing, safe and reliable banks are after all a bedrock of a healthy economy – but is having all your money in the bank really the best use for savers’ hard earned cash? We don’t think so.

Cash fund 101

Cash is not always king

Analysis: Are Kiwis using their cash investments wisely or are there better alternatives?

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of the assets in Kiwisaver. By any measure, that’s a pretty large number.

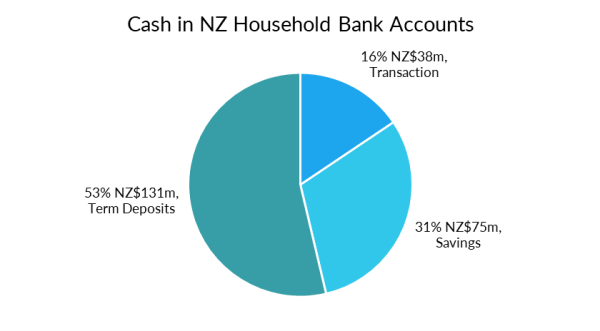

Of that $250 billion, ~15% is in transactional accounts which will likely be earning zero or near-zero interest; ~30% is in savings accounts, which are likely earning a couple of percent (possibly higher, but with potential penalties or restrictions such as limited withdrawals). The remaining ~55% is in term deposits (TD), which lock up your money for a fixed period of time and have fairly significant penalties for early withdrawal.

So while you may feel good about your interest rate return in a TD rather than in a savings account, your optionality and flexibility is severely reduced.

Source: Reserve Bank of New Zealand ‘Banks: Liabilities – Deposits by sector – S40’ as at April 2024

There is an alternative to savings accounts and TDs. An alternative where your money is invested in a potentially higher returning and tax-efficient fund where you retain the flexibility to request withdraws at any time. This alternative is an investment in a cash-like fund.

These products, which could also have names like 'Enhanced Cash' or 'Cash Plus', may be useful for many savers in New Zealand. Moving away from traditional bank products into a fund may seem like a daunting task for some savers – but take solace in the fact that the managed funds industry in New Zealand is highly regulated and fund managers are required to regularly disclose a lot of information about their funds.

When considering whether a cash-like fund may be the right choice for you, you should take a look under the hood. What sorts of assets do these funds actually hold, get an idea of the costs as well as understanding the risks?

What's in a cash fund?

To review a fund's holdings search for the fund’s fact sheets or its quarterly Fund Updates which must be displayed on the on the fund manager’s website. Or you can look on the MBIE hosted 'Disclose Register' website. The quarterly Fund Updates (QFUs) will tell you what the fund's actual investment mix is at the end of each quarter as well as its Top 10 holdings.

Typically ‘enhanced cash’ or ‘cash plus’ funds will hold a combination of cash and cash equivalents (see below for definition of cash equivalent) along with some shorter-dated New Zealand fixed interest securities i.e. bonds. All of this data will be available on a fund manager’s QFU in the fund’s actual investment mix disclosures.

Most readers are probably familiar with the concept of 'cash' - but what are 'cash equivalents'? Examples include short-dated term deposits, bank bills (tradable short-term loans to banks) and commercial paper (tradable short-term loans to New Zealand local councils and corporates).

Bank bills and commercial paper are investments that are not typically available to the average retail investor - so one way to access this asset class might be through a fund. Bonds in a cash fund would typically be short-dated fixed rate bonds, or floating-rate notes.

Credit risk and cash returns

Where possible, the QFU will also provide the relevant credit rating for the Top 10 holdings - a key way to assess the credit quality of the assets the fund is invested in. Some of these assets may have a credit rating higher than a saver's own retail bank; and some might be lower. But an investor should see an appropriate mix of credit quality along with some assets earning higher returns than prevailing bank deposit rates.

In the current high-interest environment the yields on cash funds (where ‘yield’ means the gross weighted average yield-to-maturity of the assets within the fund) are currently comparable to the advertised returns available on six month term deposits.

A quick browse of cash fund websites in New Zealand suggests gross yields are currently around the 6.00-6.30% level (before fees, charges and an individual’s tax). Of course, compared to a term deposit, a cash fund does not guarantee you any particular rate of return.

Fund returns are based on the returns of the fund’s underlying investments, which means you must be prepared to accept the risk of some losses in order to potentially make a return higher than a typical term deposit. Check out the funds’ product disclosure statement (PDS), under the minimum suggested investment time horizon to see it if matches with yours. All managed funds charge an annual management fee (unlike term deposits) and the QFU will tell you what fees are charged by the fund, plus a note if they are expected to materially change in the near future.

Cash funds offer a lot of flexibility

One of the key benefits of a cash fund over a term deposit is the ability to request your money back whenever you please. For term deposits, your bank could refuse to pay you back early or may charge you a break fee. Assets held by cash funds on the other hand will typically be tradeable securities – they can be bought or sold on the secondary market. Being able to transact these securities on the secondary market generally means that cash funds can facilitate investor applications and redemptions. Again, have a read of the fund’s PDS to make sure you understand the benefits, the other ins and outs, as well as the risks.

They provide a bigger slice of PIE

Almost all cash funds in New Zealand will be set-up as Portfolio Investment Entities (PIEs) which, depending on your marginal tax rate, may offer a significant tax benefit over holding cash in a standard bank account (which would be assessed for tax at your marginal tax rate). The recent increase to the trustee tax rate has brought PIE tax considerations to the fore for many trusts that hold savings and investments.

Forsyth Barr analysis indicates that for investors with marginal tax rates of 30%, 33% and 39% the tax benefit associated with investing in a New Zealand bond PIE fund is around 0.12%, 0.30% and 0.66% per year respectively. While this analysis applies specifically to New Zealand bonds, the same logic applies to New Zealand cash and cash equivalents, which along with bonds, are usually assessed for taxable income under the financial arrangements methodology. Many banks offer some of their savings products as PIEs as well.

Source: Forsyth Barr analysis. Assumes a pre-tax return of 6.00% on NZ bonds

Very low to low risk, but not risk-free

Another key piece of information in a fund’s QFU is its Risk Indicator. Identified by a number from one to seven that indicates the level of volatility to be expected from an investment in a fund. Cash-like funds will tend to have a risk indicator of a one or a two indicating either very low, or low, volatility.

When we put a dollar in a deposit/cash account at a bank we get a dollar back, plus some interest’ less some tax. Typically when investing in a cash fund you are exposed to the whims of the 'market' (many of the underlying investments will be ‘marked to market’) so the value of your dollar invested will fluctuate day-to-day, albeit, we believe you’ll still be likely to come out better off over the longer term – even after fund fees and your tax bill.

With so much of New Zealanders’ wealth still sitting in the bank doing very little work we think that cash funds should be a part of a well-balanced portfolio. A decent portion of this ‘cash’ may be better suited to a cash-like fund where it can be professionally managed in order to get your money working considerably harder for the likelihood of better returns with only slightly more risk.

Liam Donnelly is Fixed Interest and ESG Analyst at Octagon Asset Management

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article. Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme.